Samsung Electronics’ stock price closed at +2.96 percent. Let’s look into Samsung Electronics’ performance dividends and HBM QUAL. I’m going to start forecasting stock prices now. Samsung Electronics’ stock price closed at +2.96 percent. Let’s look into Samsung Electronics’ performance dividends and HBM QUAL. I’m going to start forecasting stock prices now.

1. Enterprise Information 2. Stock Price Analysis of Samsung Electronics 3. Samsung Electronics’ performance 4. Supply and Demand Analysis 5. Samsung Electronics’ dividend 6. Current Status of Equity 7. HBM QUAL availability 8. Samsung Electronics’ stock price outlook 1. Enterprise Information 2. Stock Price Analysis of Samsung Electronics 3. Samsung Electronics’ performance 4. Supply and Demand Analysis 5. Samsung Electronics’ dividend 6. Current Status of Equity 7. HBM QUAL availability 8. Samsung Electronics’ stock price outlook

corporate information corporate information

It is a global electronics company consisting of 227 subsidiaries, including Korea and DX division’s overseas 9 regional headquarters, DS division’s overseas 5 regional headquarters, SDC and Harman. The set business includes the DX division, which produces TVs, monitors, refrigerators, washing machines, air conditioners, smartphones, network systems, and computers. The parts business includes the DS division, which produces products such as DRAM, NAND Flash, and mobile AP, and SDC, which produces display panels such as small and medium-sized OLEDs. stock price analysis of Samsung Electronics It is a global electronics company consisting of 227 subsidiaries, including Korea and DX division’s overseas 9 regional headquarters, DS division’s overseas 5 regional headquarters, SDC and Harman. The set business includes the DX division, which produces TVs, monitors, refrigerators, washing machines, air conditioners, smartphones, network systems, and computers. The parts business includes the DS division, which produces products such as DRAM, NAND Flash, and mobile AP, and SDC, which produces display panels such as small and medium-sized OLEDs. stock price analysis of Samsung Electronics

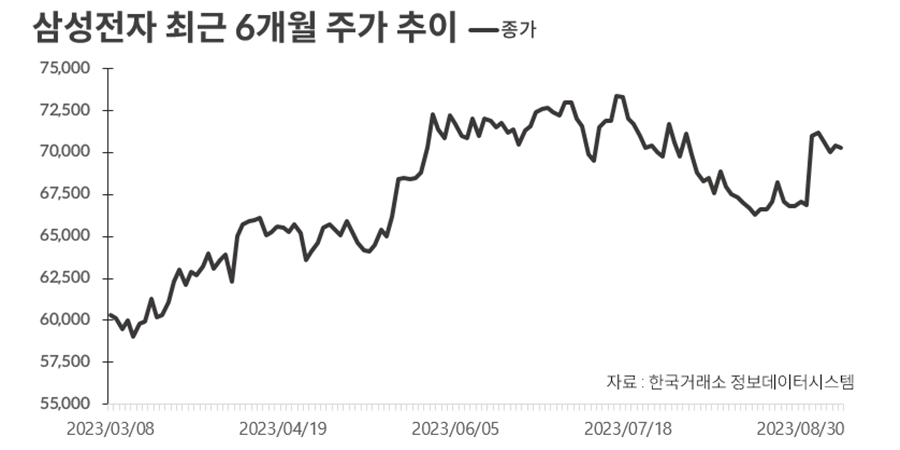

[Jubong] Samsung Electronics has been on a gradual rise within the rising channel since the decline ended in September 2022. [Jubong] Samsung Electronics has been on a gradual rise within the rising channel since the decline ended in September 2022.

Samsung Electronics’ performance Samsung Electronics’ performance

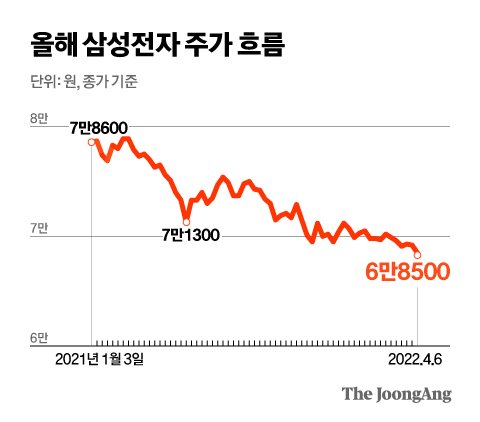

Samsung Electronics’ performance reached its highest operating profit of 51 trillion in 2021 and fell to 6 trillion operating profit, the worst year in 23 years since then. We achieved an earnings surprise of 74 trillion operating profit of 10.4 trillion won in the second quarter announced on July 4, 2012. 2020: 236.8 trillion won in sales / 35.9939 trillion in operating profit 2021: 279.6048 trillion won in sales / 51.63 trillion won in operating profit 2022: 302.2314 trillion won / 43.3766 trillion won in operating profit 2023: 258.935 trillion won / 6.567 trillion won in operating profit, the worst in 23 years since then. We achieved an earnings surprise of 74 trillion operating profit of 10.4 trillion won in the second quarter announced on July 4, 2012. 2020: 236.807 trillion in sales / 35.9939 trillion in operating profit 2021: 279.6048 trillion in sales / 51.6339 trillion in operating profit 2022: 302.2314 trillion in sales / 43.3766 trillion in 2023: 258.935 trillion in operating profit / 6.567 trillion in operating profit

Supply and Demand Analysis Supply and Demand Analysis

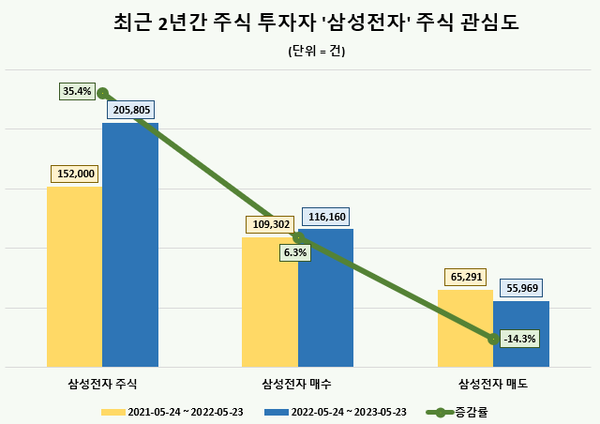

Foreigners’ supply and demand are the strongest, and institutions also participated in the acquisition in July. Currently, individual selling is the highest. Foreigners’ supply and demand are the strongest, and institutions also participated in the acquisition in July. Currently, individual selling is the highest.

dividends from Samsung Electronics dividends from Samsung Electronics

Samsung Electronics’ dividends are continuously being made and 1,444 won is being paid. The dividend yield is a dividend with a market dividend rate of 2%. 1,416 won / 2.54% in 2019 / 2,994 won / 3.7% in 2020 / 1,444 won / 1.84% in 2021 / 1,444 won / 2.61% in 2022 / 1,444% in 2023 Samsung Electronics’ dividends are continuously being paid and 1,444% in dividends are paid. The dividend yield is a dividend with a market dividend rate of 2%. 1,416 won / 2.54% in 2019 / 2,994 won / 3.7% in 2020 / 1,444 won / 1.84% in 2021 / 1,444 won / 2.61% in 2022 / 1,444 won in 2023. 1.84%

Current status of shares: Current status of shares

The largest shareholder has a 20% stake, and Samsung Life Insurance has the highest stake of 8.51% of them. The largest shareholder has a 20% stake, and Samsung Life Insurance has the highest stake of 8.51% of them.

HBM HBM What HBM What

The HBM QUAL TEST article about Samsung Electronics was published this week, but the results are still being tested with the announcement from Samsung Electronics. However, the stock price has shown a rise without the HBM QAUL yet. As the current performance is in a huge turnaround situation, the memory cycle alone seems to have recognized the current value as an undervalued section. Since the momentum of HBM still remains within the year, I think it may have a good enough impact until then. The HBM QUAL TEST article about Samsung Electronics was published this week, but the results are still being tested with the announcement from Samsung Electronics. However, the stock price has shown a rise without the HBM QAUL yet. As the current performance is in a huge turnaround situation, the memory cycle alone seems to have recognized the current value as an undervalued section. Since the momentum of HBM still remains within the year, I think it may have a good enough impact until then.

삼성전자 주가 전망 삼성전자 주가 전망

본 게시물은 주식추천은 아니지만 투자는 본인의 판단입니다 본 게시물은 주식추천은 아니지만 투자는 본인의 판단입니다

함께 읽기 좋은 기사 https://blog.naver.com/future-rich/223495050687 함께 읽기 좋은 기사 https://blog.naver.com/future-rich/223495050687

Lotte Energy Materials Stock Forecast: Higher-End Copper Baking Orders Lotte Energy Materials Stock Ends At +1.54% We’ll Watch Earnings Ahead With Higher-End Copper Baking Orders… blog.naver.com Lotte Energy Materials Stock Forecast: Higher-End Copper Baking Orders Lotte Energy Materials Stock Ends At +1.54% We’ll Watch Earnings Ahead With Higher-End Copper Baking Orders… blog.naver.com

![[공지] 낫또의 효능과 치명적인 부작용 9가지 상세하게 알고가요. (영양성분, 칼로리, 고혈압 논문) [공지] 낫또의 효능과 치명적인 부작용 9가지 상세하게 알고가요. (영양성분, 칼로리, 고혈압 논문)](https://sun.conputa.xyz/wp-content/plugins/contextual-related-posts/default.png)